AskTech Payment Gateway: Your Gateway to Seamless Financial Transactions

AskTech’s PCI-compliant Payment Gateway, powered by Amazon Web Services, ensures secure, scalable, and reliable payment processing. Meticulously designed to meet PCI DSS standards, it provides top-tier protection for cardholder data.

Payment processing is a critical aspect of a payment gateway, and it involves various features to ensure smooth and secure transactions. Here are more details on essential features within the payment processing module:

Payment Gateway Features

AI-Driven Intelligence for Smarter Routing

Fallback for Uninterrupted transactions

Maximize Profits with Cost-Based Routing

Dynamic Currency Conversion for a Global Audience

Securing Transactions with 3D Secure Authentication

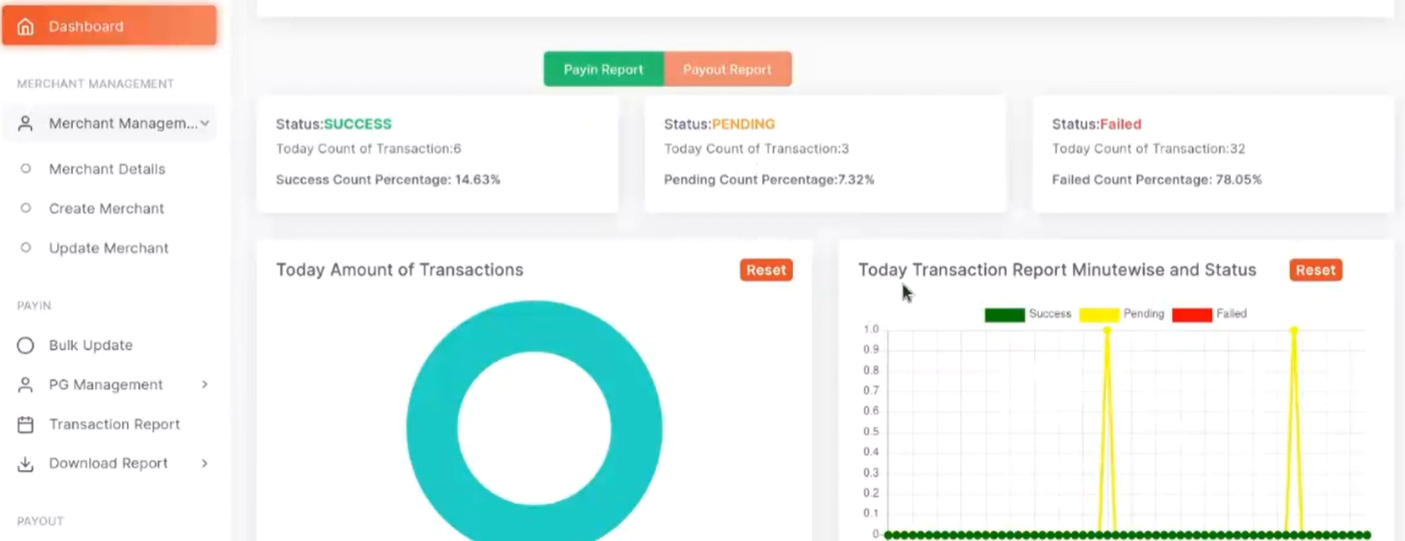

User-Friendly Dashboard for Real-Time Adjustments

Recurring Billing Made Effortless

Dynamic BIN Routing for Optimal Processing

Unleash the Power of Data with Routing Analytics

Welcome to AskTech - Your Gateway to Enterprise Software Excellence

At AskTech, we stand at the forefront of software development, specializing in creating cutting-edge enterprise-grade solutions. Our commitment to innovation, excellence, and client success makes us the go-to partner for businesses seeking to thrive in the digital era.

Payment Gateway architecture, tailored to elevate the security, scalability, and reliability of your payment processing infrastructure.

Core Competencies

AskTech boasts a unique approach to software development, understanding that enterprise solutions must seamlessly adapt to the evolving dynamics of the modern market. Our seasoned team of developers, architects, and engineers excels at translating intricate business requirements into scalable, robust, and future-ready software solutions.

Custom Software Development: Precision-Crafted Solutions : At AskTech, we understand that one size never fits all. Our Custom Software Development services are the epitome of precision craftsmanship, tailored to meet the unique needs and challenges of your business. Collaborating closely with stakeholders, we decode the intricacies of your operations, objectives, and long-term vision.

Choose AskTech Payment Gateway for a future-ready solution that connects you seamlessly to the diverse world of digital payments.

AskTech Payment Gateway: Your Gateway to Seamless Financial Transactions

At AskTech, we take pride in presenting our cutting-edge payment system designed to elevate your financial transactions. With a focus on speed, security, and reliability, our payment gateway integrates seamlessly with a variety of Indian payment gateways and banks, offering comprehensive Payin and Payout solutions. Here are 20 features that define the excellence of our service

- Multi-Gateway Integration: Connect effortlessly with a range of leading Indian payment gateways, providing users with diverse payment options.

- Bank Integration: Seamlessly integrate with major Indian banks, facilitating direct transactions and enhancing financial inclusivity.

- Payin Solutions: Enable swift and secure fund inflows with our Payin solutions, supporting various payment methods including credit cards, UPI, and digital wallets.

- Payout Solutions: Streamline fund outflows with our Payout solutions, ensuring efficient and reliable financial transactions for businesses.

- Cross-Border Transactions: Facilitate global transactions with ease, allowing businesses to operate on an international scale.

- Fast Transaction Processing: Benefit from lightning-fast transaction processing, ensuring a seamless experience for both businesses and end-users.

- Advanced Security Protocols: Implement robust security measures, including encryption and tokenization, to safeguard sensitive financial information.

- Fraud Detection and Prevention: Utilize intelligent algorithms to detect and prevent fraudulent activities, ensuring the integrity of every transaction.

- Real-time Transaction Tracking: Empower users with real-time tracking of their transactions, fostering transparency and trust.

- Multi-Currency Support: Conduct transactions in multiple currencies, catering to the global nature of modern businesses.

11. Customizable Payment Pages: Tailor payment pages to align with your brand, enhancing the overall user experience.

12. Recurring Billing: Support subscription-based models with automated recurring billing, enhancing convenience for businesses and customers.

13. API Integration: Integrate our payment gateway seamlessly into your existing systems with our robust API solutions.

14. Comprehensive Reporting: Access detailed reports and analytics, providing valuable insights into transaction trends and financial performance.

15. Mobile Wallet Integration: Cater to the mobile-centric landscape with integrated support for popular mobile wallets.

Multi-Gateway Integration: Connecting You to Diverse Payment Options

AskTech’s Payment Gateway goes beyond the conventional by seamlessly integrating with a variety of leading Indian payment gateways. This unique feature empowers businesses and users with a plethora of payment options, ensuring flexibility, convenience, and broad market reach.

Diverse Payment Options:

- Connect effortlessly with a range of payment gateways, including but not limited to Razorpay, PayU, CCAvenue, and more.

- Offer users the freedom to choose their preferred payment method, from credit cards and net banking to digital wallets and UPI.

Enhanced Customer Reach:

- Tap into a wider audience by providing a payment experience tailored to diverse preferences.

- Attract and retain customers by offering the payment options they are most comfortable with, fostering customer loyalty.

Competitive Edge:

- Gain a competitive advantage by providing a comprehensive array of payment options compared to competitors.

- Position your business as forward-thinking and customer-centric in the rapidly evolving landscape of digital transactions.

Unified Integration Experience:

- Simplify integration efforts with a unified API that consolidates the intricacies of multiple payment gateways.

- Save development time and resources by avoiding the need for separate integrations for each gateway.

Business Adaptability:

- Cater to different business models and industries with tailored payment gateways.

- Adjust seamlessly to the unique needs of your business, whether it’s e-commerce, subscriptions, or digital services.

Market Expansion:

- Facilitate expansion into new markets by integrating with region-specific gateways, allowing businesses to operate on a global scale.

- Adapt to local payment preferences and regulations effortlessly, enhancing the adaptability of your business.

Why Multi-Gateway Integration Matters:

In a diverse and dynamic market, the ability to offer multiple payment options is not just a convenience but a strategic advantage. AskTech’s Multi-Gateway Integration ensures that businesses stay ahead of the curve, adapting to evolving customer preferences, expanding their reach, and securing a competitive edge in the ever-changing payment landscape.

Choose AskTech Payment Gateway for a future-ready solution that connects you seamlessly to the diverse world of digital payments.

Payin Solutions: Swift and Secure Fund Inflows

AskTech’s Payin Solutions stand at the forefront of facilitating effortless and secure fund inflows. Designed to streamline the process of receiving payments, this feature caters to businesses seeking a fast, reliable, and user-friendly experience for their customers.

Multiple Payment Methods:

- Credit Cards: Enable users to make payments using major credit cards, providing a universally accepted method.

- UPI (Unified Payments Interface): Tap into the popularity of UPI, allowing users to pay directly from their bank accounts.

- Net Banking: Facilitate seamless transactions by integrating with various net banking services.

- Digital Wallets: Support popular digital wallets, enhancing convenience for users who prefer this mode of payment.

Instant Payment Confirmation:

- Provide real-time confirmation of successful payments, offering users immediate feedback on their transactions.

- Enhance user trust and satisfaction by eliminating delays in payment processing.

Customizable Payment Pages:

- Tailor payment pages to align with your brand identity, creating a seamless and branded user experience.

- Reinforce brand trust by presenting a consistent and professional interface throughout the payment process.

Mobile Optimization:

- Ensure a responsive design that caters to users across various devices, particularly mobile users.

- Optimize the payment experience for the growing number of users who prefer making transactions on their smartphones.

Smart Checkout Flow:

- Design an intuitive and user-friendly checkout process, minimizing steps and reducing friction in the payment journey.

- Implement a smart flow that guides users through the payment process with clarity and efficiency.

Real-Time Transaction Tracking:

- Empower users with the ability to track their transactions in real-time.

- Provide detailed insights into transaction status, giving users confidence and transparency.

Multi-Currency Support:

- Accommodate global transactions by supporting payments in multiple currencies.

- Appeal to an international audience and facilitate cross-border transactions effortlessly.

Secure Payment Environment:

- Implement bank-level encryption and stringent security protocols to ensure the confidentiality and integrity of payment information.

- Prioritize the security of both user data and financial transactions.

Payout Solutions:

AskTech’s Payout Solutions represent a sophisticated framework designed to simplify and optimize the process of fund outflows. Aimed at businesses seeking a reliable, secure, and streamlined payout mechanism, this feature ensures that disbursing funds becomes a seamless operation.

Flexible Payout Options:

- Offer a range of payout methods, including bank transfers, digital wallets, and other electronic transfer options.

- Cater to diverse payout preferences, allowing businesses to adapt to the needs of their recipients.

Automated Payouts:

- Implement automated payout processes, reducing manual intervention and minimizing the scope for errors.

- Enhance operational efficiency by automating repetitive payout tasks.

Bulk Payouts:

- Facilitate bulk payouts to multiple recipients simultaneously.

- Ideal for businesses managing payroll, affiliate commissions, or any scenario involving large-scale fund disbursement.

Customizable Payout Schedules:

- Allow businesses to define customized payout schedules based on their specific requirements.

- Provide flexibility in choosing regular intervals or specific dates for fund disbursement.

Comprehensive Reporting:

- Generate detailed reports on payout transactions, offering insights into disbursement patterns and facilitating financial reconciliation.

- Ensure transparency and accountability in the payout process.

Real-Time Transaction Tracking:

- Empower users with the ability to track their transactions in real-time.

- Provide detailed insights into transaction status, giving users confidence and transparency.

Secure Fund Transfer:

- Implement bank-grade encryption and security protocols to safeguard the integrity of fund transfer.

- Prioritize the security of financial transactions and sensitive information during the payout process.

Compliance with Regulatory Standards:

- Ensure adherence to relevant regulatory standards and financial regulations in the jurisdictions where payouts are conducted.

- Mitigate compliance risks and build trust with stakeholders.

Real-Time Payout Tracking:

- Empower businesses and recipients with real-time tracking of payout transactions.

- Enhance transparency and provide immediate feedback on the status of fund disbursements.

Multi-Currency Support:

- Facilitate payouts in multiple currencies, accommodating global scenarios and international recipients.

- Simplify cross-border transactions and expand the reach of fund outflows.

Why Payout Solutions Matter:

Efficient fund outflows are integral to maintaining positive relationships with employees, partners, and affiliates. AskTech’s Payout Solutions offer a strategic advantage by providing businesses with the tools needed to disburse funds seamlessly, securely, and in alignment with their unique operational needs.

Cross-Border Transactions:

AskTech’s Cross-Border Transactions feature positions our payment gateway as a global financial facilitator, enabling businesses to transcend geographical boundaries effortlessly. This feature is designed to streamline international transactions, providing a seamless, secure, and efficient platform for businesses engaged in global commerce.

Multi-Currency Support:

- Facilitate transactions in multiple currencies, catering to the diverse financial landscapes of different countries.

- Provide users with the flexibility to conduct transactions in their preferred currency, minimizing conversion complexities.

Real-Time Currency Conversion:

- Implement real-time currency conversion to ensure accurate and up-to-date exchange rates.

- Empower users to view and transact in their local currency, promoting transparency and preventing currency-related surprises.

Global Payment Methods:

- Integrate with a variety of international payment methods, including major credit cards, popular e-wallets, and region-specific payment options.

- Ensure that users from different parts of the world can choose payment methods familiar to them.

Compliance with International Regulations:

- Adhere to international financial regulations and compliance standards to ensure legality and security in cross-border transactions.

- Mitigate risks associated with regulatory variations across jurisdictions.

Risk Management for Cross-Border Transactions:

- Implement advanced risk management tools to detect and prevent fraud in cross-border transactions.

- Enhance the security of international transactions, protecting businesses and users from unauthorized activities.

Global Connectivity:

- Establish connections with banking and financial institutions worldwide to facilitate seamless fund transfers.

- Enable businesses to operate on a global scale by providing a network of financial partners across borders.

Localized User Experience:

- Provide a localized and user-friendly experience for users from different regions.

- Adapt language, payment methods, and interfaces to align with the preferences of users in specific countries.

Cross-Border Reporting and Analytics:

- Generate comprehensive reports and analytics specific to cross-border transactions.

- Provide businesses with insights into global transaction trends, facilitating informed decision-making.

Why Cross-Border Transactions Matter:In an interconnected global economy, the ability to conduct transactions across borders is a strategic necessity for businesses. AskTech’s Cross-Border Transactions feature not only simplifies the complexity of international payments but also positions businesses to capitalize on global opportunities, fostering growth and resilience in an increasingly borderless world.

Choose AskTech Payment Gateway for Cross-Border Transactions that transcend barriers and empower businesses to participate confidently in the international marketplace.

Advanced Security Protocols:

AskTech’s commitment to data security is unwavering, and our Advanced Security Protocols form the bedrock of our payment gateway. With a robust framework designed to safeguard sensitive information, this feature employs state-of-the-art measures to ensure the highest level of security for every financial transaction.

End-to-End Encryption:

- Employ end-to-end encryption to protect sensitive data throughout the entire transaction lifecycle.

- Ensure that data, including payment details and personal information, is indecipherable to unauthorized entities.

Tokenization Technology:

- Implement tokenization to replace sensitive data with unique tokens, rendering it useless for malicious purposes even if intercepted.

- Add an extra layer of security by reducing the exposure of actual cardholder data.

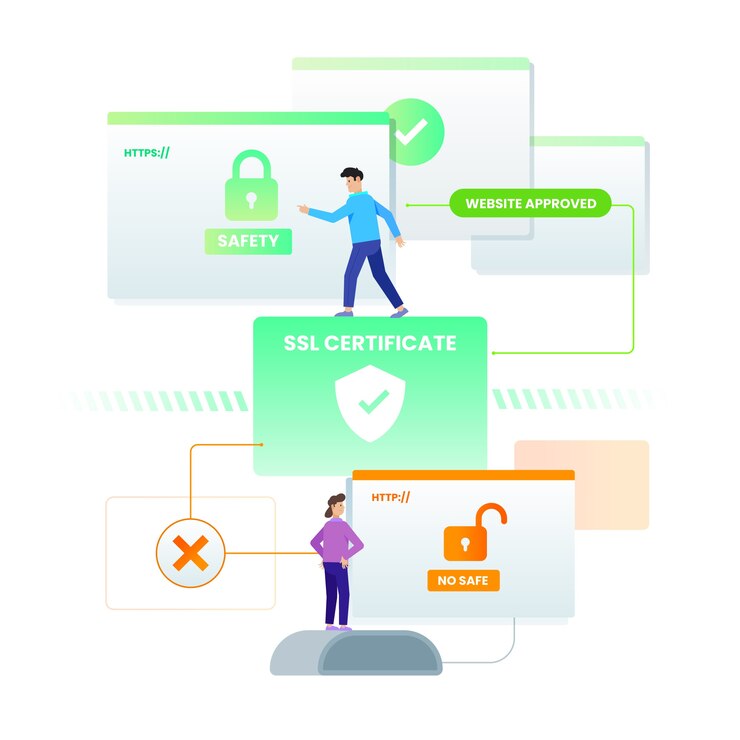

Secure Socket Layer (SSL) Certification:

- Utilize SSL certificates to establish a secure and encrypted connection between users and the payment gateway.

- Guarantee the confidentiality and integrity of data during transit.

Two-Factor Authentication (2FA):

- Integrate Two-Factor Authentication for an additional layer of user verification.

- Enhance the security of user accounts by requiring a secondary authentication step beyond passwords.

Biometric Authentication:

- Support biometric authentication methods, such as fingerprint or facial recognition, for enhanced user identity verification.

- Provide a secure and convenient means of accessing the payment system.

Fraud Detection Algorithms:

- Deploy advanced algorithms to detect and prevent fraudulent activities in real-time.

- Continuously analyze transaction patterns to identify anomalies and take immediate action.

Device Fingerprinting:

- Implement device fingerprinting to recognize and authenticate devices used for transactions.

- Enhance security by identifying and flagging any unusual device activity.

Regular Security Audits:

- Conduct regular security audits and assessments to identify vulnerabilities.

- Proactively address and patch any potential security loopholes to ensure a constantly fortified system.

Security Information and Event Management (SIEM):

- Utilize SIEM tools to monitor, analyze, and respond to security events in real-time.

- Enable swift responses to potential security threats through comprehensive event management.

Data Masking:

- Implement data masking techniques to conceal sensitive information in internal systems.

- Further protect data, even within the organization, by limiting access to the essentials for authorized personnel.

Why Advanced Security Protocols Matter:

In the realm of digital transactions, security is paramount. AskTech’s Advanced Security Protocols not only meet industry standards but exceed them, ensuring that businesses and users can transact with the utmost confidence. By adopting a multi-layered approach, we fortify the financial fortress against evolving cyber threats, providing a secure environment for every transaction.

Choose AskTech Payment Gateway for Advanced Security Protocols that set the standard for safeguarding financial data in an ever-changing digital landscape.

API Integration:

AskTech’s commitment to flexibility and adaptability shines through our robust API Integration feature. Designed to empower developers and businesses, this functionality allows for seamless integration into various systems, enhancing the overall efficiency and interoperability of the payment gateway.

Versatile API Support:

- Provide comprehensive support for RESTful APIs, enabling compatibility with a wide range of platforms and systems.

- Ensure that developers can integrate our payment gateway effortlessly into their applications using industry-standard API protocols.

SDKs for Major Programming Languages:

- Offer Software Development Kits (SDKs) for major programming languages, including but not limited to Java, Python, JavaScript (Node.js), and PHP.

- Simplify the integration process by providing language-specific tools and resources for developers.

Framework Compatibility:

- Ensure compatibility with popular web development frameworks, such as Django, Flask, Ruby on Rails, and Laravel.

- Facilitate developers in seamlessly integrating our payment gateway into their existing frameworks.

Comprehensive Documentation:

- Provide extensive and developer-friendly documentation, including API reference guides, code samples, and tutorials.

- Empower developers with the resources needed for smooth integration, reducing development time and efforts.

Webhooks for Real-Time Updates:

- Implement webhooks to enable real-time updates and notifications for various events, such as successful payments, chargebacks, and refunds.

- Allow businesses to stay informed and responsive to critical transaction events instantly.

Customizable Endpoints:

- Offer customizable API endpoints, allowing businesses to tailor integration to their specific requirements.

- Provide flexibility for developers to define endpoints that align with their application architecture.

OAuth 2.0 for Secure Authorization:

- Implement OAuth 2.0 protocol for secure and standardized authorization.

- Enhance security by allowing third-party applications to access the payment gateway on behalf of users without exposing sensitive credentials.

Sandbox Environment for Testing:

- Provide a dedicated sandbox environment for developers to test API integration in a controlled setting.

- Facilitate rigorous testing, reducing the likelihood of issues in a live production environment.

Rate Limiting and Quotas:

- Implement rate limiting and usage quotas to manage and control API traffic.

- Ensure fair usage and prevent abuse of API resources.

Versioning for Compatibility:

- Support versioning in the API to ensure backward compatibility as the system evolves.

- Allow businesses to adopt new features without disrupting existing integrations.

Why API Integration Matters:

API Integration is the backbone of modern software ecosystems. AskTech’s comprehensive API Integration features not only ensure a seamless connection with our payment gateway but also empower developers to create tailored solutions that align perfectly with their business objectives. This interoperability fosters innovation and efficiency in the ever-evolving landscape of digital transactions.

Choose AskTech Payment Gateway for API Integration that opens the doors to a world of possibilities, enabling businesses to seamlessly integrate and leverage the full potential of our payment system.

Compliance with Regulatory Standards: Upholding Legal and Security Mandates

AskTech recognizes the paramount importance of adhering to regulatory standards and security mandates to ensure the legality, integrity, and security of financial transactions. Our commitment to compliance extends beyond mere adherence — we strive to surpass industry standards, providing businesses and users with a payment gateway that meets or exceeds the most stringent regulatory requirements.

PCI DSS Certification:

- Obtain and maintain Payment Card Industry Data Security Standard (PCI DSS) certification, affirming our commitment to securing cardholder data.

- Regularly undergo rigorous assessments to ensure ongoing compliance with industry-established security standards.

Data Protection Laws Compliance:

- Adhere to global data protection laws, including GDPR, HIPAA, and other relevant regulations.

- Safeguard user privacy and ensure the lawful and ethical processing of personal and financial information.

AML and KYC Compliance:

- Implement robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to prevent illicit financial activities.

- Conduct thorough customer verification processes in compliance with international financial regulations.

Cross-Border Transaction Regulations:

- Stay informed about and adhere to regulations governing cross-border transactions.

- Ensure compliance with currency exchange regulations and financial laws in the countries where transactions occur.

Secure Data Transmission:

- Offer customizable API endpoints, allowing businesses to tailor integration to their specific requirements.

- Provide flexibility for developers to define endpoints that align with their application architecture.

Biometric Verification:

- Offer customizable API endpoints, allowing businesses to tailor integration to their specific requirements.

- Provide flexibility for developers to define endpoints that align with their application architecture.

Regular Compliance Audits:

- Conduct regular compliance audits to assess adherence to regulatory standards.

- Engage external auditors and internal compliance teams to identify areas for improvement and ensure continuous compliance.

Legal Framework Adherence:

- Keep abreast of changes in legal frameworks related to financial transactions and data security.

- Adjust policies and procedures to align with evolving legal requirements.

Transaction Integrity and Accountability:

- Implement measures to ensure the integrity and accountability of financial transactions.

- Provide detailed transaction logs and reports for auditing purposes.

Incident Response and Reporting:

- Develop and maintain an incident response plan for prompt action in the event of security incidents.

- Comply with regulatory requirements for reporting security breaches and incidents to relevant authorities.

Consumer Protection Compliance:

- Align with consumer protection laws to ensure fair and transparent business practices.

- Provide clear terms of service, billing information, and dispute resolution processes to protect consumers.

Why Compliance with Regulatory Standards Matters:

Compliance with regulatory standards is not only a legal obligation but a fundamental aspect of establishing trust in financial transactions. AskTech’s commitment to exceeding regulatory requirements reflects our dedication to creating a secure and transparent financial ecosystem. By upholding these standards, we assure businesses and users that their transactions are conducted within the bounds of the law, fostering trust and confidence in our payment gateway.

Choose AskTech Payment Gateway for Compliance with Regulatory Standards that goes beyond the baseline, ensuring the highest level of security, legality, and ethical conduct in every financial transaction.

Fraud Detection and Prevention: Safeguarding Every Transaction

In the dynamic landscape of digital transactions, fraud prevention is paramount. AskTech’s Fraud Detection and Prevention feature is a sophisticated suite of tools and algorithms designed to identify and mitigate fraudulent activities, ensuring the integrity and security of every financial transaction.

Machine Learning Algorithms:

- Employ advanced machine learning algorithms to analyze transaction patterns and detect anomalies.

- Continuously refine models to adapt to evolving fraud tactics, enhancing detection accuracy.

Behavioral Analytics:

- Implement behavioral analytics to understand and identify patterns of genuine user behavior.

- Flag deviations from normal behavior, triggering additional scrutiny for potentially fraudulent transactions.

IP Geolocation Tracking:

- Utilize IP geolocation tracking to verify the physical location of users during transactions.

- Flag transactions originating from unexpected or high-risk locations for further investigation.

Device Fingerprinting:

- Employ device fingerprinting techniques to recognize and authenticate devices used for transactions.

- Identify and flag transactions from devices with unusual or suspicious attributes.

Velocity Checks:

- Set velocity checks to monitor the frequency and speed of transactions from a single user or device.

- Identify and block transactions that deviate from normal usage patterns, preventing mass-scale fraudulent activities.

Real-Time Transaction Monitoring:

- Monitor transactions in real-time to identify and halt potentially fraudulent activities as they occur.

- Provide instant alerts and automated responses to mitigate the impact of fraudulent attempts.

Pattern Recognition:

- Develop and refine pattern recognition algorithms to identify specific fraud indicators.

- Stay ahead of emerging fraud trends by continuously updating patterns based on new threat intelligence.

Customizable Rule Engine:

- Offer a customizable rule engine that allows businesses to define specific fraud prevention rules.

- Tailor fraud detection criteria based on the unique characteristics of the business and its user base.

Collaborative Threat Intelligence:

- Engage in collaborative threat intelligence sharing with industry partners and security networks.

- Stay informed about emerging threats and leverage shared intelligence for proactive fraud prevention.

Why Fraud Detection and Prevention Matters:

As digital transactions become more prevalent, so do sophisticated fraud tactics. AskTech’s Fraud Detection and Prevention feature is not just a shield; it’s a proactive guardian of financial integrity. By leveraging cutting-edge technologies and continuous adaptation, we provide businesses with the tools needed to stay ahead of fraudsters, ensuring a secure and trustworthy payment environment.

Choose AskTech Payment Gateway for Fraud Detection and Prevention that sets the standard for safeguarding every transaction, protecting businesses and users from the ever-evolving landscape of fraudulent activities.

Credit Cards: Universally Accepted Transactions

Credit cards represent a ubiquitous and widely accepted form of payment globally. AskTech’s payment gateway seamlessly integrates with major credit card providers, empowering users to make secure and swift transactions with the convenience of their credit cards.

Major Card Network Support:

- Implement stringent security measures to handle and protect cardholder data.

- Adhere to PCI DSS standards to ensure the highest level of security in credit card transactions.

Tokenization for Enhanced Security:

- Employ tokenization technology to replace sensitive credit card information with unique tokens.

- Enhance security by reducing the risk of exposing actual card details during transactions.

3D Secure Authentication:

- Integrate 3D Secure authentication for an additional layer of security in online credit card transactions.

- Provide users and merchants with increased confidence in the authenticity of each transaction.

Recurring Billing for Subscription Models:

Support recurring billing for subscription-based services, allowing businesses to seamlessly bill customers at regular intervals.

Ensure convenience for users and enhance business models that rely on recurring payments.

UPI (Unified Payments Interface): Streamlining Bank Transactions

Unified Payments Interface (UPI) has gained immense popularity for its simplicity and efficiency in facilitating direct bank-to-bank transactions. AskTech’s payment gateway taps into the ubiquity of UPI, providing users with a convenient and instant payment method.

Direct Bank-to-Bank Transactions:

- Enable users to make payments directly from their bank accounts to recipients’ bank accounts using UPI.

- Facilitate seamless fund transfers without the need for additional intermediaries.

QR Code Integration:

- Integrate QR code support for UPI payments, simplifying the payment initiation process for users.

- Enhance user experience by providing a quick and straightforward method for making payments.

UPI Mandate for Scheduled Payments:

- Support UPI mandates for scheduled payments, allowing users to set up and authorize recurring transactions.

- Enable users to automate regular payments, such as utility bills and subscriptions.

Real-Time Transaction Confirmation:

Provide real-time confirmation of successful UPI transactions, offering users immediate feedback on their payments.

Enhance transparency and user confidence in the transaction process.

Net Banking: Seamlessly Connecting with Financial Institutions

Net Banking remains a prevalent method for online transactions, offering users the convenience of conducting transactions directly from their bank accounts. AskTech’s payment gateway ensures seamless integration with various net banking services.

Multiple Bank Integration:

- Integrate with a diverse range of banks to provide users with options for net banking transactions.

- Support users across different banks, enhancing inclusivity and accessibility.

Secure Authentication Protocols:

- Implement secure authentication protocols for users to log in and authorize net banking transactions.

- Prioritize the security of user accounts and transaction details.

Real-Time Bank Account Verification:

- Conduct real-time verification of bank accounts to ensure the accuracy of transaction details.

- Minimize the risk of errors and enhance the reliability of net banking transactions.

Account Balances and Transaction History:

- Provide users with access to their account balances and transaction history through the net banking interface.

- Enhance user convenience by consolidating financial information in one platform.

Digital Wallets: Convenience Redefined

Digital wallets have become integral to modern payment ecosystems, offering users a convenient and swift method for making transactions. AskTech’s payment gateway seamlessly integrates with popular digital wallets, enhancing convenience for users who prefer this mode of payment.

Support for Popular Digital Wallets:

- Integrate with leading digital wallets such as PayPal, Apple Pay, Google Pay, and others.

- Cater to a broad user base by supporting the digital wallets that users are most familiar with.

One-Click Payments:

- Enable one-click payments for users who have linked their digital wallets to their accounts.

- Streamline the checkout process and reduce friction for users, fostering a seamless payment experience.

In-App Payments:

- Facilitate in-app payments for users who prefer to make transactions within mobile applications.

- Support the growing trend of mobile-centric transactions for enhanced user convenience.

Tokenization for Enhanced Security:

- Implement tokenization for digital wallet transactions, adding an extra layer of security.

- Safeguard user data and financial information during digital wallet transactions.

Why Credit Cards, UPI, Net Banking, and Digital Wallets Matter:

These payment methods collectively form the backbone of modern digital transactions, catering to diverse user preferences and technological advancements. AskTech’s integration with major credit cards, UPI, net banking, and digital wallets ensures that businesses and users can engage in transactions using their preferred methods, fostering a user-friendly and inclusive payment environment.

Security Measures and Compliances

At AskTech, we understand the critical importance of safeguarding sensitive cardholder data and ensuring the security of payment transactions. As part of our commitment to maintaining the highest standards in data security, we present a comprehensive PCI DSS (Payment Card Industry Data Security Standard) compliance checklist outlining the rigorous security measures we implement for our payment gateway. This checklist is a testament to our dedication to providing a secure and reliable environment for your payment processing needs.

1. Build and Maintain a Secure Network and Systems:

Firewalls:

- Implemented and maintained firewalls to protect cardholder data.

- Ensured the avoidance of vendor-supplied defaults for system passwords and other security parameters.

Protected Data Transmission:

- Encrypted transmission of cardholder data across open, public networks.

- Utilized strong cryptography and security protocols.

2. Protect Cardholder Data:

Data Encryption:

- Implemented encryption for sensitive data during transmission and storage.

- Adhered to industry-accepted algorithms and key management practices.

Sensitive Authentication Data:

- Avoided storing sensitive authentication data after authorization.

- Ensured masking of PANs when displayed.

3. Maintain a Vulnerability Management Program:

Regular Scanning:

- Conducted regular scans and risk assessments.

- Addressed vulnerabilities in a timely manner.

Patch Management:

- Established a process to identify, prioritize, and apply security patches.

- Ensured all systems and software are up to date.

4. Implement Strong Access Control Measures:

Access Control Policies:

- Developed and implemented access control policies.

- Restricted access to cardholder data to individuals with a business need.

Unique IDs:

- Assigned a unique ID to each person with computer access.

- Implemented multi-factor authentication for remote access.

Restricted Physical Access:

- Limited physical access to cardholder data.

- Monitored and controlled access to data storage areas.

5. Regularly Monitor and Test Networks:

Logging and Monitoring:

- Implemented logging mechanisms for all system components.

- Conducted regular reviews of logs and security events.

Regular Security Testing:

- Conducted regular security testing, including penetration testing and vulnerability assessments.

- Documented and addressed any identified vulnerabilities.

6. Maintain an Information Security Policy:

Security Policy Development:

- Developed and maintained a comprehensive information security policy.

- Ensured all personnel are aware of and comply with security policies.

Incident Response Plan:

- Established an incident response plan.

- Regularly tested and updated the plan.

Employee Training:

- Provided regular security awareness training for all personnel.

- Ensured employees understand their roles in protecting cardholder data.

7. Additional Considerations:

Network Segmentation:

- Implemented network segmentation to isolate cardholder data.

- Restricted traffic between different network segments.

Data Retention Policies:

- Established data retention policies.

- Regularly purged unnecessary cardholder data.

Service Provider Oversight:

- Maintained a list of all service providers.

- Ensured service providers adhere to PCI DSS requirements.

Documentation and Compliance Records:

- Maintained detailed documentation of security measures and compliance efforts.

- Regularly reviewed and updated documentation.

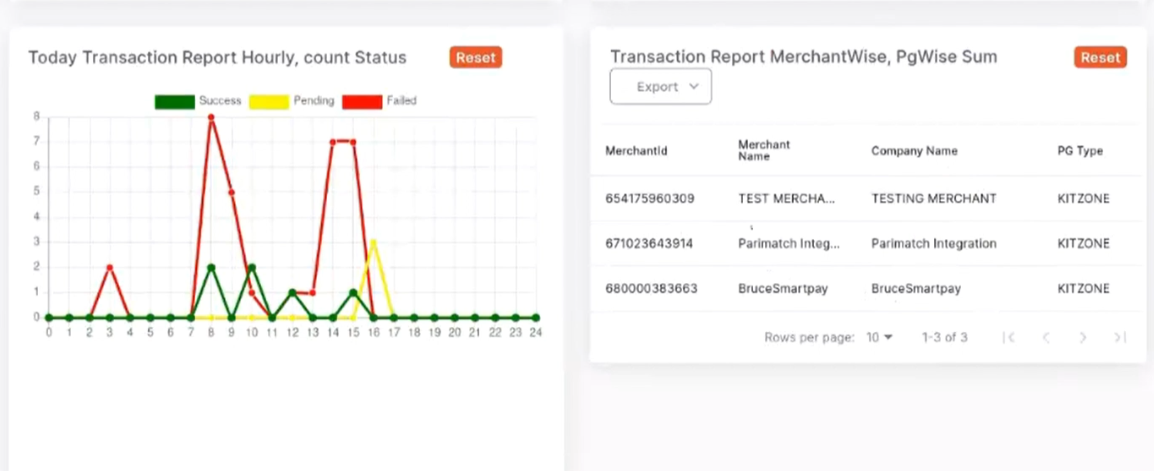

Payment Gateway Services

Payment Gateway :

- Monthly Transactions of Approximately $200 Million

- PayIn and Payout Services supported

- PCI DSS certified Infrastructure

- Completely Based on Java Spring and ReactJs

- Cloud Partner Amazon Web Services

- Multiple payment Options supported NetBanking, UPI, Credit and Debit Card, Wallets

- More than 25 Payment aggregators and banks supported.

- Dynamic payment selection policy

multiple challenges for Payment Gateways:

faced multiple challenges in their existing payment processing system:

- Transaction Declines: High rates of transaction declines, were negatively impacting customer satisfaction and revenue.

- Inefficiencies in Routing: The existing payment gateway lacked sophisticated routing features, resulting in suboptimal transaction routes and increased processing costs.

Solution:

Asktech, partnered with our team to implement our cutting-edge payment gateway, designed to address their specific challenges and unlock new possibilities for their business.

Implementation of Key Features:

Load Balancing and Failover Mechanism: Load balancing enhanced system performance, preventing downtime, while the failover mechanism ensured uninterrupted transactions, even in the face of unexpected technical issues.

Dynamic Routing Strategies: Introducing threshold-based, time-of-day, and card type routing, Companies. experienced a significant reduction in transaction declines, resulting in increased revenue and improved customer satisfaction.

Cost-Based Routing: Save money on every transaction! We route your payments through the most cost-effective channels, keeping your processing fees low.Our intelligent platform analyzes transaction details and chooses the most affordable payment routes, optimizing your costs.

AI-Driven Optimization: Our AI-driven routing optimization continuously analyzed transaction data, adapting routing strategies in real-time to maximize efficiency and success rates.

Results:

Transaction Success Rates Soared: With the implementation of advanced routing features, companies witnessed a remarkable increase in transaction success rates, reducing declines and boosting revenue.

Enhanced Customer Trust: Transparent billing descriptors and instant payment notifications improved customer understanding and trust in the payment process, leading to increased loyalty.

Optimized Processing Costs: Cost-based routing and dynamic currency conversion significantly reduced processing fees, resulting in improved profitability.

Adaptable and Future-Ready: The smart dashboard and customization options allow to adapt routing strategies based on changing business needs, ensuring the payment gateway remained future-proof.

Conclusion:

By leveraging the innovative features of our payment gateway Client, transformed its global transaction landscape. The tailored solution not only addressed existing challenges but also positioned for future growth and success in the fiercely competitive e-commerce industry.

This case study stands as a testament to the power of advanced payment processing solutions in reshaping the trajectory of businesses, unlocking new opportunities, and providing a foundation for sustained success in the global marketplace.

AskTech PCI-Compliant Payment Gateway Architecture on AWS

- Amazon VPC (Virtual Private Cloud):Ensuring a secure foundation, our architecture utilizes AWS VPC to isolate and control network access. We implement private and public subnets, ensuring a structured environment for secure communication.

- AWS Elastic Load Balancing (ELB):To guarantee high availability and fault tolerance, our payment gateway utilizes AWS ELB for distributing incoming traffic across multiple instances. SSL termination is seamlessly managed by ELB, enhancing encryption/decryption processes.

- AWS WAF (Web Application Firewall):Safeguarding against common web exploits, AskTech’s architecture incorporates AWS WAF. Customized rules are implemented to filter malicious traffic, providing an additional layer of defense for your payment processing infrastructure.

- Amazon RDS (Relational Database Service):Sensitive payment data is stored securely using Amazon RDS, featuring encryption at rest. Our architecture deploys automatic backups and regular snapshots, ensuring data integrity and availability.

- Amazon S3 (Simple Storage Service):Static assets, logs, and backups are stored in Amazon S3, adopting server-side encryption for an additional layer of data security. Access permissions are diligently audited and monitored to maintain the confidentiality of stored information.

- AWS Key Management Service (KMS):Encryption keys used across AWS services are managed by AWS KMS. Our architecture ensures the secure handling and regular rotation of encryption keys, contributing to robust data protection.

- AWS CloudWatch:AskTech employs AWS CloudWatch for comprehensive monitoring, detecting abnormal behavior, and automating responses. Alarms are configured to notify administrators of critical metrics, ensuring swift responses to potential issues.

- AWS CloudTrail:Recording API calls for auditing and compliance, AWS CloudTrail logs all activity within the payment gateway infrastructure. These logs are stored securely in an S3 bucket, forming an integral part of our comprehensive audit trail.

- AWS Identity and Access Management (IAM):Ensuring secure access to AWS services, our architecture leverages IAM. Strict policies and roles are defined, adhering to the principle of least privilege. Regular audits and updates are conducted to maintain access integrity.

- AWS Certificate Manager (ACM):Managing SSL/TLS certificates for secure communication, ACM is integrated seamlessly into our architecture. This ensures the provision, management, and deployment of SSL/TLS certificates with minimal administrative overhead.

AskTech Payment Gateway Technologys

Payment processing is a critical aspect of a payment gateway, and it involves various features to ensure smooth and secure transactions. Here are more details on essential features within the payment processing module

User Authentication and Authorization:

- Secure user registration and authentication mechanisms.

- Role-based access control for different user types (merchants, administrators, etc.).

- Two-factor authentication for enhanced security.

Payment Processing:

- Support for various payment methods, including credit/debit cards, bank transfers, digital wallets, and alternative payment methods.

- Multi-currency support with real-time currency conversion.

- Ability to handle one-time and recurring payments.

Security Features:

- Encryption of sensitive data (SSL/TLS).

- PCI DSS compliance for handling credit card information.

- Tokenization to protect customer payment information.

- Regular security audits and vulnerability assessments.

Fraud Prevention and Detection:

- Advanced fraud detection algorithms.

- Risk scoring and analysis for transactions.

- Real-time monitoring of suspicious activities.

- Integration with third-party fraud prevention services.

Integration and APIs:

- Well-documented APIs for seamless integration with e-commerce platforms and websites.

- SDKs for popular programming languages.

- Webhooks for real-time notifications of events (e.g., successful transactions, chargebacks).

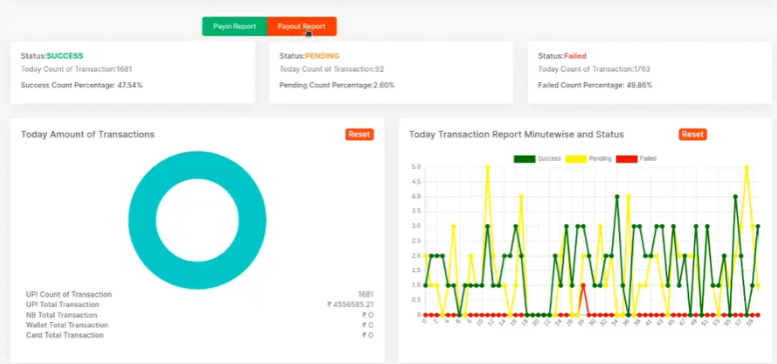

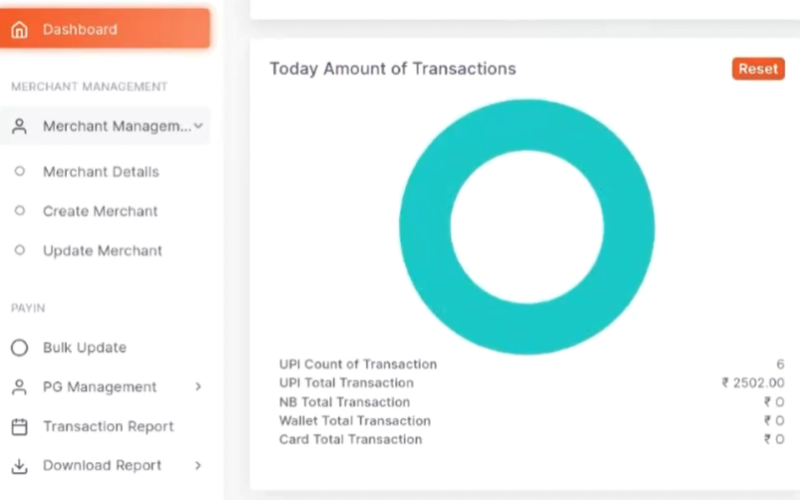

Dashboard and Reporting:

- Intuitive merchant dashboard for managing transactions.

- Detailed reporting and analytics tools.

- Transaction history and search functionality.

Refunds and Chargebacks:

- Easy process for merchants to issue refunds.

- Handling of chargeback disputes with documentation support.

- Notification to merchants about chargebacks and dispute status.

Customer Communication:

- Automated email notifications for successful transactions, refunds, and chargebacks.

- Customer support contact information provided in case of issues.

- Communication regarding scheduled maintenance or system updates.

Bank Settlement and Reconciliation:

- Integration with banks for fund settlement.

- Automated reconciliation of transactions.

- Support for multiple settlement currencies.

Localization and Compliance:

- Compliance with international and local regulations.

- Localization of payment pages and messages.

- VAT handling and compliance.

Scalability and Reliability:

- Scalable architecture to handle a large volume of transactions.

- Redundancy and failover mechanisms for system reliability.

- Load balancing for optimal performance.

Mobile Responsiveness:

- Mobile-friendly payment pages.

- Mobile SDKs for in-app payments.

Customer Support Tools:

- 24/7 customer support.

- Support ticketing system.

- Knowledge base or FAQs for self-help.

Legal Documentation:

- Generation of terms of service and privacy policy for merchants and users.

- Compliance with data protection laws (e.g., GDPR).

Adaptive UI/UX:

- Responsive design for a seamless user experience across devices.

- A/B testing for optimizing the user interface.

Testing Environment:

- Sandbox environment for testing without real transactions.

- Comprehensive test cases for different scenarios.

Adaptation to Emerging Technologies:

- Integration with emerging payment technologies (e.g., blockchain, cryptocurrency).

- Support for new regulatory requirements and compliance standards.

Accessibility:

- Accessibility features for users with disabilities.

- Compliance with web content accessibility guidelines (WCAG).

Feedback Mechanism:

- User feedback collection through surveys or feedback forms.

- Continuous improvement based on user suggestions and issues.

Dynamic Currency Conversion:

- Provide customers with the option to view prices and make payments in their local currency.

- Real-time conversion rates and transparent disclosure of currency conversion fees.

Recurring Billing:

- Automated scheduling and processing for subscription-based services.

- Customizable billing cycles and automated notifications for upcoming payments.

Tokenization:

- Securely store sensitive customer information by replacing card details with tokens.

- Enable recurring payments without exposing actual credit card details.

Split Payments:

- Support for splitting payments among multiple recipients (marketplace payments).

- Automated distribution of funds to different accounts.

3D Secure Authentication:

- Implement 3D Secure protocols for an additional layer of authentication during online transactions.

- Compliance with 3D Secure 2.0 for enhanced security and improved user experience.

Card-on-File:

- Securely store customer card information for future transactions.

- Compliance with card network rules and regulations regarding stored credentials.

Instant Payment Notifications (IPN):

- Real-time notifications to merchants about successful payments, chargebacks, and refunds.

- Enable merchants to automate post-payment processes.

Dynamic Descriptor:

- Customizable descriptors on customers’ billing statements to improve clarity.

- Helps customers recognize and remember the transaction.

Fallback Mechanism:

- Graceful handling of transactions in case the primary payment method fails.

- Automatic fallback to alternative payment methods.

Offline Payments:

- Support for manual entry of payment details for offline transactions.

- Facilitate phone orders or in-person payments.

Multi-Language Support:

- Display payment pages and communications in multiple languages.

- Cater to a diverse user base in different regions.

Batch Processing:

- Efficient processing of a large number of transactions in batches.

- Streamline settlement and reconciliation processes.

Dynamic Routing:

- Route transactions dynamically based on factors such as cost, availability, or performance.

- Optimize payment flow for efficiency.

Dynamic BIN Routing:

- Route transactions based on the issuing bank’s BIN (Bank Identification Number).

- Optimize routing for better success rates and lower costs.

Offline Transaction Support:

- Capability to store and forward transactions when the system is temporarily offline.

- Ensure no loss of data during downtime

Account Updater:

- Automatic updating of card information for recurring payments.

- Reduce declined transactions due to expired or updated card details.

Invoicing and Billing:

- Generate and send invoices directly through the payment gateway.

- Customizable invoice templates and automated reminders for overdue payments

Welcome to AskTech - Your Gateway to Enterprise Software Excellence

At AskTech, we stand at the forefront of software development, specializing in creating cutting-edge enterprise-grade solutions. Our commitment to innovation, excellence, and client success makes us the go-to partner for businesses seeking to thrive in the digital era.

Core Competencies:

AskTech boasts a unique approach to software development, understanding that enterprise solutions must seamlessly adapt to the evolving dynamics of the modern market. Our seasoned team of developers, architects, and engineers excels at translating intricate business requirements into scalable, robust, and future-ready software solutions.

Custom Software Development: Precision-Crafted Solutions:

At AskTech, we understand that one size never fits all. Our Custom Software Development services are the epitome of precision craftsmanship, tailored to meet the unique needs and challenges of your business. Collaborating closely with stakeholders, we decode the intricacies of your operations, objectives, and long-term vision.

Our seasoned development team, employing agile methodologies, ensures flexibility and adaptability throughout the development lifecycle. The result? Bespoke software solutions that not only address your current requirements but also possess the scalability to evolve alongside the ever-changing dynamics of the business landscape.

Cybersecurity Solutions: Fortifying Your Digital Fortress:

As digital landscapes evolve, so do threats. AskTech’s Cybersecurity Solutions are designed to fortify your digital fortress. We implement robust measures, including:

- Endpoint Protection: Safeguarding devices and networks against malicious entities.

- Data Encryption: Securing sensitive data through advanced encryption protocols.

- Access Controls: Restricting unauthorized access to critical systems.

Our cybersecurity protocols are not just reactive; they’re proactive, anticipating and neutralizing potential threats before they become a challenge.

Leveraging the Power of Cloud Services: A Seamless Revolution:

Cloud services have become the backbone of modern software solutions, and at AskTech, we master the art of seamless integration. Picture your custom applications effortlessly intertwined with leading cloud services providers like AWS, Azure, or Google Cloud. The benefits are as vast as the cloud itself:

- Scalability: Grow your applications effortlessly in tandem with business expansion.

- Flexibility: Optimize performance and cost-effectiveness with dynamic resource allocation.

- Accessibility: Empower your team with anytime, anywhere access for enhanced collaboration.

Security is paramount in our cloud-integrated solutions, with rigorous measures like encryption and access controls safeguarding your sensitive data.

Why AskTech

As we unveil the myriad possibilities encapsulated in AskTech’s comprehensive suite of services, we invite you to embark on a journey where innovation meets precision, and technological prowess converges with the needs of the modern business landscape. At AskTech, we don’t just provide solutions; we architect transformative experiences. Your success is our North Star, guiding our every endeavor as we navigate the ever-evolving currents of technology.

As you consider the horizon of possibilities that our Custom Software Development, Cloud Services Integration, Complex ERP Solutions, and Cybersecurity offer, envision a future where your business not only adapts but thrives. This is more than a service introduction; it’s an invitation to redefine the way you operate, collaborate, and succeed in the digital age.

Join us at AskTech, where each line of code is a step toward innovation, each integration a bridge to efficiency, and each security measure a shield for your digital ambitions. The journey to excellence begins with the choices you make today. Choose AskTech, and let’s chart a course for unparalleled success together.

Partner with Us for Comprehensive IT

We’re happy to answer any questions you may have and help you determine which of our services best fit your needs.

Call Us: +971 551156103 / +971 529032042

Your benefit

- Client-oriented

- Independent

- Competent

- Results-driven

- Problem-solving

- Transparent